How Does Kansas Assess Sales Tax On Antique Cars

Physical proof of insurance on the vehicle showing issue and expiration date will be required. If consignment property is sold for 10000 the consignee gets a 15 commission for selling the property then the consignee must collect 635 in sales tax from the purchaser of the property and must charge the consignor 95 in sales tax on the 1500 sales commission.

Sales Tax On Cars And Vehicles In Kansas

You can remit your payment through their online system.

How does kansas assess sales tax on antique cars. Short term auto rentals are taxed at 9. 79-3603 Retailers sales tax imposed. This document mainly just validates the purchase price of the deal although if the sale involves an antique vehiclethat is one thats 35 years old or olderthis form can officially transfer ownership without a title.

Motor vehicle sales are subject to a 6 purchase or use tax. Once the vehicle is registered you will be mailed a personal property tax statement every year in December. Antique registration means that you pay 25 once for.

Kansas has 677 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. You have four options for filing and paying your Kansas sales tax. It is the responsibility of the Kansas county appraiser to classify all taxable and exempt real and personal property.

Kansas permits the transfer of ownership of antique vehicles which are those vehicles that are 35 years old or more with a bill of sale. All you have to do is login. General Information on State Sales Tax Virtually every type of business must obtain a State Sales Tax Number.

Watercraft County Average Tax Rate - 2021 WCATR 2021 WCATR 2020 WCATR 2019 WCATR 2018 WCATR 2017 WCATR 2016 WCATR 2015 WCATR 2014 WCATR 16M 20M Motor Vehicle Appraised Value Chart - 2021 Chart 2020 Chart 2019 Chart 2018 Chart. How to File and Pay Sales Tax in Kansas. In most cases the tax is fixed at 1200.

Tax is due on the entire price of the sale including shipping and handling. To get the difference you will need to contact the County Treasurer and give them the year make and model of the new as well as the old vehicle and tell them you need to know the difference in the taxes. Sometimes bills of sale also are accepted when titling a vehicle bought in a private sale or when determining appropriate sales taxes.

Counties and cities can charge an additional local sales tax of up to 35 for a maximum possible combined sales tax of 10. An Bill of Sale Form TR-312 which can be downloaded and printed from the Kansas Department of Revenue DOR website. All the information you need to file your Kansas sales tax return will be waiting for you in TaxJar.

Sale of 20000 motor vehicle to a resident of another state where the sales tax rate on motor vehicles is seven percent. Consignor gets 8405 as net proceeds from the sale. Delaware gets good marks for sales tax but it does charge a Documentation Fee which is 45 percent of the vehicle sale price or the NADA value whichever is higher.

However on the opposite end is Oklahoma which has the highest car sales tax at 1150 followed by Louisiana with 1145. Call it what you like thats still a tax. Two states have car sales tax rates below 5.

Antique vehicles are taxed annually as personal property just as any other vehicle. If both taxable and exempt items are being shipped together the percentage of the shipping charge that relates to the taxable items must be taxed. Under this section property subject to taxation is.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. Sales tax may also be due at the time you title and register the vehicle. Article 36KANSAS RETAILERS SALES TAX 79-3601 Title of act.

Decals for Antique Vehicle Model Year Tags. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. There are also local taxes up to 1 which will vary depending on region.

Kansas has a lower state sales tax than 827 of states. North Carolina and Hawaii at 3 and 45 respectively. They are authorized by their respective charters to levy their own taxes on meals lodging and entertainment.

Additional to certain other taxes. Cost- 4500 registration fee in addition to personal property tax and sales tax. In addition there is a county.

The state is very clear about its taxation rule with regard to shipping. If your business sells products on the internet such as eBay or through a storefront and the item is shipped within the same state sales tax must be collected from the buyer and the sales tax must be paid on the collected tax to the state. File online - File online at the Kansas Department of Revenue.

791459 - Classification for the purposes of ad valorem taxation is delineated in Article 11 Section 1 of the Kansas Constitution. Burlington does collect the local option sales tax. You asked 1 how the statutes define an antique vehicle for purposes of the property tax assessment limit on such vehicles and 2 for a legislative history of the assessment limit law.

Florida sales tax is due at the rate of six percent on the 20000 sales price of the vehicle. Delaware Montana New Hampshire and Oregon do not levy sales tax on cars. No discretionary sales surtax is due.

Any other vehicle that is bought or sold by a Kansas resident must submit an assigned title to transfer ownership. 4000 registration fee is a one-time fee. The Kansas state sales tax rate is 65 and the average KS sales tax after local surtaxes is 82.

The fee to transfer is 1250 plus the difference in the property tax. This means that a 20000 vehicle in Oklahoma would cost an additional 2300. To be subject to the 500 property tax assessment limit the law requires a vehicle to 1 be at least 20 years old 2 be of historical interest and.

223 N Kansas St Edwardsville Il 62025 Realtor Com

Municipal Airport Kansas City Missouri Now Called Wheeler Kansas City Missouri Kansas City Downtown Kansas City

Kansas Sales Use Tax Guide Avalara

704 Bertrand St Manhattan Ks 66502 Realtor Com

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Just Found The Vintage Cash Register And Scale Co 1900 S Cash Registers And Scales That Have Been R Vintage Cash Register Cash Register National Cash Register

1115 Heritage Dr Mcpherson Ks 67460 Mls 40196 Zillow

Vehicles Johnson County Kansas

2920 Kansas Ave Santa Monica Ca 90404 Mls 20 638804 Redfin

2920 Kansas Ave Santa Monica Ca 90404 Mls 20 638804 Redfin

Brief History Of Troost Avenue City Pictures Kansas City Missouri Kansas City

5510 Kansas Ave Nw Washington Dc 20011 Mls Dcdc518340 Redfin

Winsteads Cc Plaza 1940 S Country Club Plaza Kansas City Kansas City Missouri Kansas

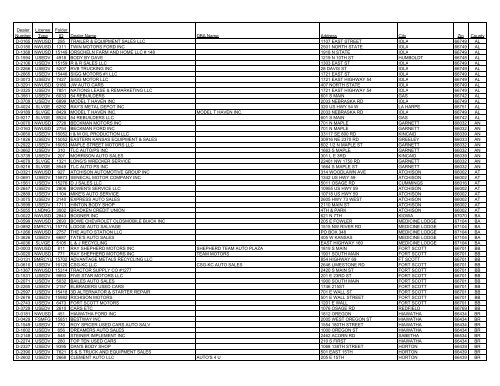

Dealer Kansas Department Of Revenue

Empire Theater 4608 Troost In The 1940s Burned In A Fire In 1960s And Most Of This Block Remained Empty For Kansas City Missouri City Pictures Kansas City